In 2015, Congress passed the Federal Civil Penalties Inflation Adjustment Act of 2015 (the “Inflation Adjustment Act”) to direct federal agencies to adjust the civil monetary penalties for inflation every year. Civil penalties ensure compliance with federal regulation by incentivizing employers not to violate federal regulation and providing federal agencies the power to ensure compliance. However, when penalties are too low, or have failed to be increased for inflation, compliance with federal regulation remains stagnant.

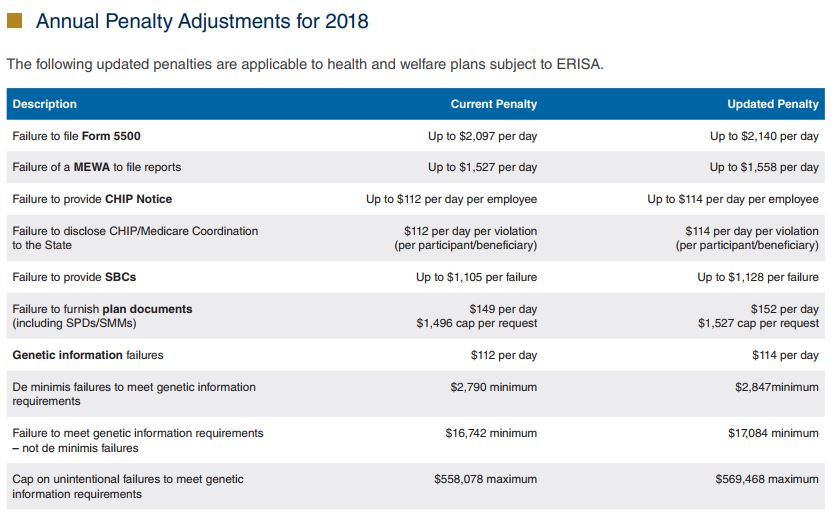

The Department of Labor (DOL) recently published the annual adjustments for 2018 that increase certain penalties applicable to employee benefit plans.

The updated penalties went into effect on January 2, 2018 and apply to penalties assessed after the effective date.

Employer Action

Private employers, including non-profits, should ensure employees receive required notices timely (SBC, CHIP, SPD, etc.) to prevent civil penalty assessments. In addition, employers should ensure Form 5500s are properly and timely filed. Finally, employers facing document requests from EBSA should ensure documents are provided timely, as requested.

To read more, check out the original post on Capstone Compliance, here.